All-In-One Enterprise Lending Solutions

Overcome daily challenges like compliance, competition, security, data management, loan quality, and productivity. With PowerLender, an Aventra company, you can manage more loans and lending programs, capitalize on new business opportunities, and improve customer engagement all in one loan origination system.

Mortgage, Consumer, and Commercial Lending in One Single System

With PowerLender, you have the ability to adapt to constantly changing market conditions, while also focusing on growth, lowering costs, and mitigating risk enterprise wide. Our flexible, business rules-based LOS meets all of your unique lending needs and conforms to your lending processes today and well into the future. Close more loans and deliver outstanding service with PowerLender, your end-to-end lending solution and trusted technology partner.

With PowerLender, you can process Conventional mortgages that adhere to Fannie Mae (DU) and Freddie Mac (LPA) automated underwriting guidelines, plus FHA, VA, FHLB, and all Portfolio Mortgage products with ease.

Features

Integrated With 70+ Third-Party Service Providers

Complete Control Over Your Workflow

Dynamic Web-Based Reporting

Data Quality Checks

Electronic Signature Integration

Product & Pricing Engine

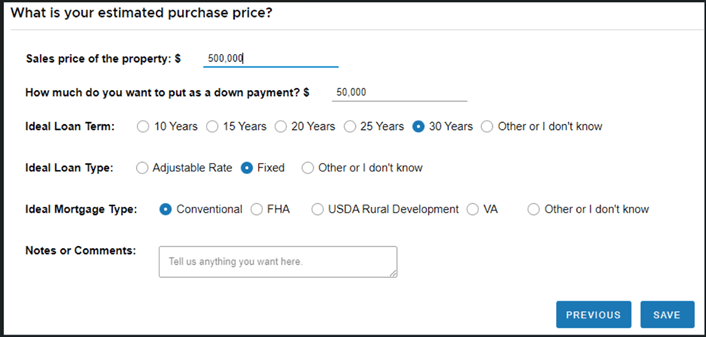

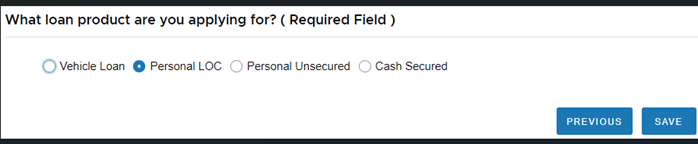

LoanPilot™

LoanPilot is an intuitive, cost-effective Point-of-Sale system that supports all loan types including Mortgage, Equity Loans, Consumer and HELOC loan applications designed by loan officers.

- Borrowers can apply online using a PC or mobile device, any time from any place.

- Features a document upload, tracking center, and pipeline reporting

- Fully customizable loan application

PRODUCTS

Streamline daily lending tasks from online point-of-sale to the secondary mortgage market using our flexible, end-to-end system. PowerLender can be deployed as a traditional client/server LOS or as a hosted online configuration.

Originates and processes mortgage, consumer, commercial, home equity, construction, multifamily, non-QM, manufactured housing, SBA, C&I, energy efficiency, ag/farm, Land & Lot, commercial real estate, equipment, investment, and nearly any other type of loan.

Loan types – CONV, FHA, VA, ARM, Portfolio, FHLB, HE’s, HELOC’s, Construction, Auto, Unsecured Personal, Loan on Savings, and much more!

Provides single-family lending automation for HFA’s

PowerLender® Integrations

Appraisal Management

Automated Underwriting

Compliance Services

Credit Reporting

Document Preparation

e-Delivery

Electronic Signatures

Flood Services

Geocode

Imaging

Mortgage Insurance

Secondary Marketing Systems

Servicing Systems

Title & Recording Fee Services

4506 / Income Verification

Miscellaneous

Point of Sale

PowerLender Web Services

Appraisal Management

Compliance Services

CREDIT REPORTING

Document Preparation

e-DELIVERY / ELECTRONIC SIGNATURES

Flood Services

Geocode

Imaging

Mortgage Insurance

Secondary Marketing Systems

Title & Recording Fee Services

4506 / Income Verification

Miscellaneous

Point of Sale

PowerLender Web Services

PowerLender is proud to partner and integrate with the following web services:

Ready to get started?

Connect with us to discuss your lending needs.

CUSTOMER SUCCESS STORy

Resources

Revolutionize Your Workflow:

Embrace Loan Automation Today!

connect with us